28+ How much mortgage can i take

If youre following this general rule you shouldnt spend more than 28 of your gross income what you take home before taxes on your mortgage payment principal and interest. Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien.

Second Story Addition Home Addition Plans Floor Plans Ranch Floor Plans

The 28 rule.

. That means if you earn 75000 a year before taxes you should spend no more than. 801010 loans consist of a first mortgage 80 and a second mortgage 10 that total 90 of the purchase price and a 10 down payment. Mortgage loan basics Basic concepts and legal regulation.

There are two different ways you can repay your mortgage. It can take around a month for a mortgage application to go to offer but it can be quicker. This can vary depending on your individual.

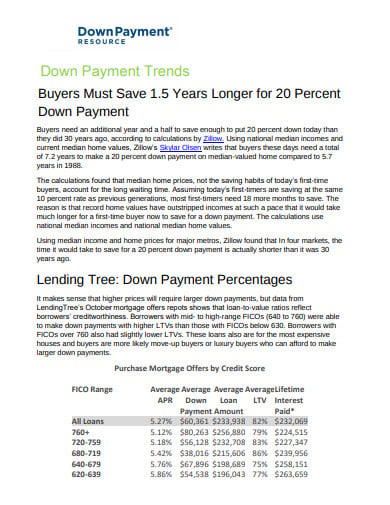

When you take out a mortgage you agree to pay the principal and interest over the life of the loan. The usual rule of thumb is that you can afford a mortgage two to 25 times your income. Most lenders ideally like to see a down payment of around 20 of the price of the homePutting 20 down on your home eliminates the need for private mortgage insurance PMI requirements though may lenders allow buyers to purchase their home with smaller down payments.

The amount you spend on housing should not exceed 36 of your gross monthly pay or 28 of your gross income plus all other monthly debt payments. It states that your total household debt shouldnt exceed 36 so. Deciding how much house you can afford.

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. The principle is pretty simple. A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan.

A common rule of thumb used by lenders in determining mortgage affordability is for the estimated mortgage payment to be no more than 28 of a borrowers monthly gross income. The mortgage should be fully paid off by the end of the full mortgage term. The most common rule of thumb to determine how much you can afford to spend on housing is.

No more than 25 to 28 of your monthly income should go toward your mortgage payment. Base 074 to 280225. The calculator also helps you determine the effects of different interest rates and levels of personal income on how much mortgage you can afford.

To figure out how much you can afford simply take your monthly take-home pay and divide it by four. To calculate the amount of equity in your home review your mortgage amortization schedule to find out how much of your mortgage payments went toward paying down the principal of the loan. Most lenders prefer 28.

And for most people it can take decades to pay down a mortgage. If interest rates go down in the future refinancing your mortgage can help. Private mortgage insurance PMI is required for borrowers of conventional loans with a down payment of less than 20.

Capital and interest or interest only. The average interest rate for a 30-year mortgage has broken 6 a level it hasnt hit since 2008 reaching 612 this week. How Much of a Mortgage Can I Afford.

The 28 36 rule. While you may have heard of using the 2836 rule to calculate affordability the correct DTI ratio that lenders will use to assess how much house you can afford is 3643. This rule takes the 28 rule one step further.

That could change after the Federal Reserve raises its interest rate. Before you can buy your own property there are several steps you must take to qualify for a loan. If youre not sure how much of your income should go toward housing follow the tried-and-true 2836 percent rule.

Calculate how much mortgage you can realistically afford by using these easy online tools. Maximum is 50 with compensating factors. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

In the first quarter of 2022 the typical first-time buyer actually spent more than 28 percent of income on their mortgage payments. A mortgage in itself is not a debt it is the lenders security for a debt. With an interest only mortgage you are not actually paying off any of the loan.

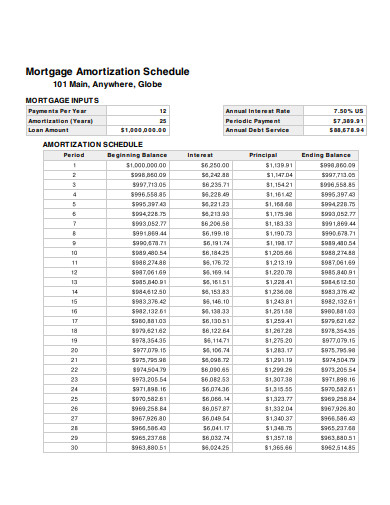

This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income and your. Year Beginning balance Monthly payment Total. Your interest rate is applied to your balance and as you pay down your balance the amount you pay in interest changes.

At 60000 thats a 120000 to 150000 mortgage. Many financial advisors believe that you. Generally speaking most prospective homeowners can afford to finance a property whose mortgage is between two and two-and-a-half times their annual gross.

If you do have to take out a mortgage Ramsey says you should finance your home with a 15-year mortgage rather than a 30-year. How much mortgage payment can I afford. Mortgage insurance protects the mortgage lender against loss if a borrower defaults on a loan.

How Much Mortgage Can I Afford if My Income Is 60000. PMI typically costs between 05 to 1 of the entire loan amount. Base 074 to 280225.

The average homeowner puts about 10 down when they buy. A good way to look at how much house you can forward is to use the popular 2836 rule. With a capital and interest option you pay off the loan as well as the interest on it.

How To Make Ends Meet When Social Security Is No Longer Enough. Lenders often use the 2836 rule as a sign of a healthy DTImeaning you wont spend more than 28 of your gross monthly income on mortgage. He also says that your mortgage payments including insurance and.

The down payment also has an. Our maximum mortgage calculator helps you calculate the maximum monthly mortgage payment and total mortgage amount you can afford. Gifts or loans from relatives and programs like an 801010 combination loan can help you avoid PMI.

For example if your take-home pay is 5000 and you divide it by four youll get 1250. Mortgage lenders will evaluate your ability to repay your loan as well as how much you might be able to borrow. Get your finances in order so you can enjoy your later years.

By Casey Bond Inflation 2022. Then 539 variable Monthly repayments.

Tables To Calculate Loan Amortization Schedule Free Business Templates

Land Lord Rental Property Rental Property Management Free Property Rental Property

28 Coffee Station Ideas Built Into Your Kitchen Cabinets Decor Snob Kitchen Design Trends Kitchen Design Home Decor Kitchen

/AgencyBonds_LimitedRiskAndHigherReturn32-9a575588ab6b4e4484cc80d0a8f9710c.png)

Agency Bonds Limited Risk And Higher Return

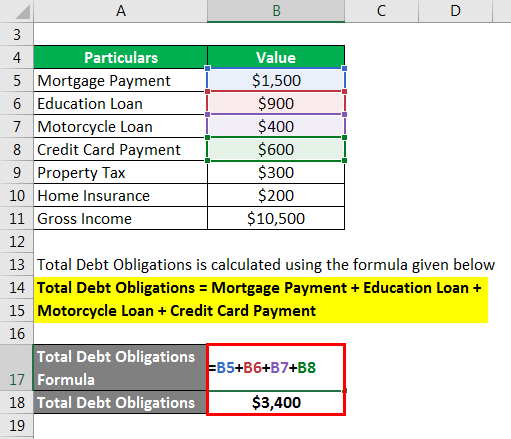

Total Debt Service Ratio Explanation And Examples With Excel Template

Tables To Calculate Loan Amortization Schedule Free Business Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

Sample Letter Of Explanation For Mortgage Refinance Luxury Cash Out Letter Template Konusu Lettering Letter Templates Business Letter Template

Loan Servicing How Does Loan Servicing Work With Example

Ex 99 1

11 Mortgage Amortization Schedule Templates In Pdf Doc Free Premium Templates

Total Debt Service Ratio Explanation And Examples With Excel Template

Sample Notice Of Default By Assignee To Obligor Free Fillable Pdf Forms Form Default Sample

10 Zero Down Payment Mortgage Templates In Pdf Doc Free Premium Templates

28 Ways To Save Money Each Month Hanfincal Com

Land Lord Rental Property Rental Property Management Free Property Rental Property

Total Debt Service Ratio Explanation And Examples With Excel Template